In this article, we will see how to solve "Exemption of HRA u/s 10(13a shall not be more than minimum of HRA received or 50% of basic Salary)" error. Last night when I was trying to file my Income Tax then I noticed that whenever I try to fill the HRA exemption from Form 16 under Section 10(13a) it is always giving "Exemption of HRA u/s 10(13a shall not be more than minimum of HRA received or 50% of basic Salary)" error and does not allow me to save the information.

This error was quite a surprise for me because I was filling the same information as it was given in Form 16. I am sure like me lot of Salaried people might be facing this error irrespective of ITR they are filling. So here I am going to explain what exactly went wrong and how to fix this error.

Error "Exemption of HRA u/s 10(13a shall not be more than minimum of HRA received or 50% of basic Salary)"

Also Read: Important Questions on the Sexual Harassment of Women at Workplace Act, 2013

While filing Income Tax return, it is always advised to follow our Form 16 along with the recently introduced AIS/TIS information to fill the details correctly. But it is Form 16 which contains the detailed information about our Gross Salary, HRA, Exemptions and other deductions. In my case also all these details were mentioned in my Form 16 but I noticed that none of the information were prefilled in the Schedule Salary section. This is quite common with most of the people who has to fill the details manually.

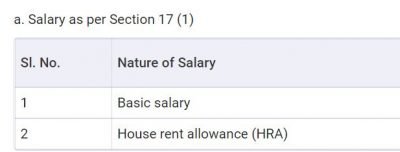

Usually you can directly add your Gross Salary given in Form 16 under Section 17(1) by choosing it as Basic Salary in ITR. Then you can fill other details in Section 17(2), Section 17(3) etc. Finally you can add the details and confirm the Salary Income section. This works fine until and unless you don't have any exemptions to provide.

For example, here we are discussing about HRA exemptions where if you have any exemptions to take then you need to mention it under Section 10(13a). But the problem is system will not allow to take the HRA exemptions if you have not added the HRA component in your Salary section. You only added Basic Salary. This is exactly the problem I faced. I didn't mentioned about the HRA component separately and hence the system was not allowing me to take HRA exemptions.

So the next big thing is how to fix this problem. Well to fix this problem, you need to add the HRA component as part of your Gross Salary and to get the HRA Component, you need to look at your Salary slips or Part B of Form 16 where all the Salary break will be mentioned including HRA component. So you need to deduct the HRA component from Gross Salary and mention it separately by adding HRA component in ITR.

Once you add it, now you have two components added in Section 17(1) - Basic Salary and HRA where Basic salary will now contain all the components except HRA. A sum of both will now be calculated as your Gross Salary. Now if you go to Section 10(13a) and try to add the HRA exemptions one more time then you can notice that the error "Exemption of HRA u/s 10(13a shall not be more than minimum of HRA received or 50% of basic Salary)" will get disappeared and now you should be able to add the details as specified in Form 16.

It might throw a warning that you cannot claim both HRA and Section 80GG together but you can safely ignore this warning if you are filling this right and just click on Add. That's it !! You are done. You can now proceed with other Schedules. Happy Filing !!

Thanks buddy.

Thanks for your valuable advice

Thank you so much! I wish I had found your article sooner, it would have saved a lot of anxiety.

Thanks buddy, that actually worked

Thanks a lot

Thank you very much for your much needed help. I watched so many YouTube videos but no one explained the way you explained. Thank you so so much.

Thanks a lot. This solved the issue.

Thanks a lot, it was very much helpful.

Brilliant explanation. Thanks a ton.

Explained very well in simple words for a layman to understand. Excellent

This saved so much of time, thanks a ton!

thx man it really helped

Thank you dear

Very Useful, Thank You

Very informative and helpful

Thank you so much, it helped me alot

Thank you, you have given much relief with your guidance.

Thanks you saved my time 🙂

Thanks a lot